Why Exit Readiness?

A proactive and well-structured exit readiness program is essential for protecting enterprise value and preparing the business for exit planning, succession, or any major transaction and anticipate potential questions from buyers. It builds trust with buyers and investors, reduces risk, and ensures a smooth transaction process. Radial supports mid-market companies with a holistic approach that creates transparency and enables deliberate, value-driven actions for a successful exit.

Starting Early for a Successful Exit Readiness

The duration of each project depends on its individual scope and requirements and therefore cannot be generalized. The timeline below serves as an example to illustrate our approach and provide a better understanding of the typical phases. Your specific project schedule will be predefined together during the initial planning stage.

A successful exit strategy begins with clear structure, defined milestones, and early preparation. Our proven process creates transparency and ensures every step aligns with your strategic objectives. While the exact timeline varies depending on the scope and complexity of the transaction, a typical plan looks like this:

Ready to Plan Your Succession?

Whether you’re approaching a potential sale or want to proactively plan your succession, now is the right moment to evaluate your exit readiness. We help you prepare your company professionally, structure all critical processes, and ensure that your transition runs smoothly while clearly highlighting the true value of your business. Review your exit readiness and set up a free consultation

Efficient Exit Planning Through Data-Driven Execution

Transparency, speed, and precision come from leveraging modern technology. Our digital tools and data models provide a reliable foundation for due diligence, valuation, and reporting.

Key Elements of Exit Readiness

A successful sale requires structure, transparency, and strategic preparation. These core elements ensure your company is professionally positioned for an exit while identifying potential risks before they become issues.

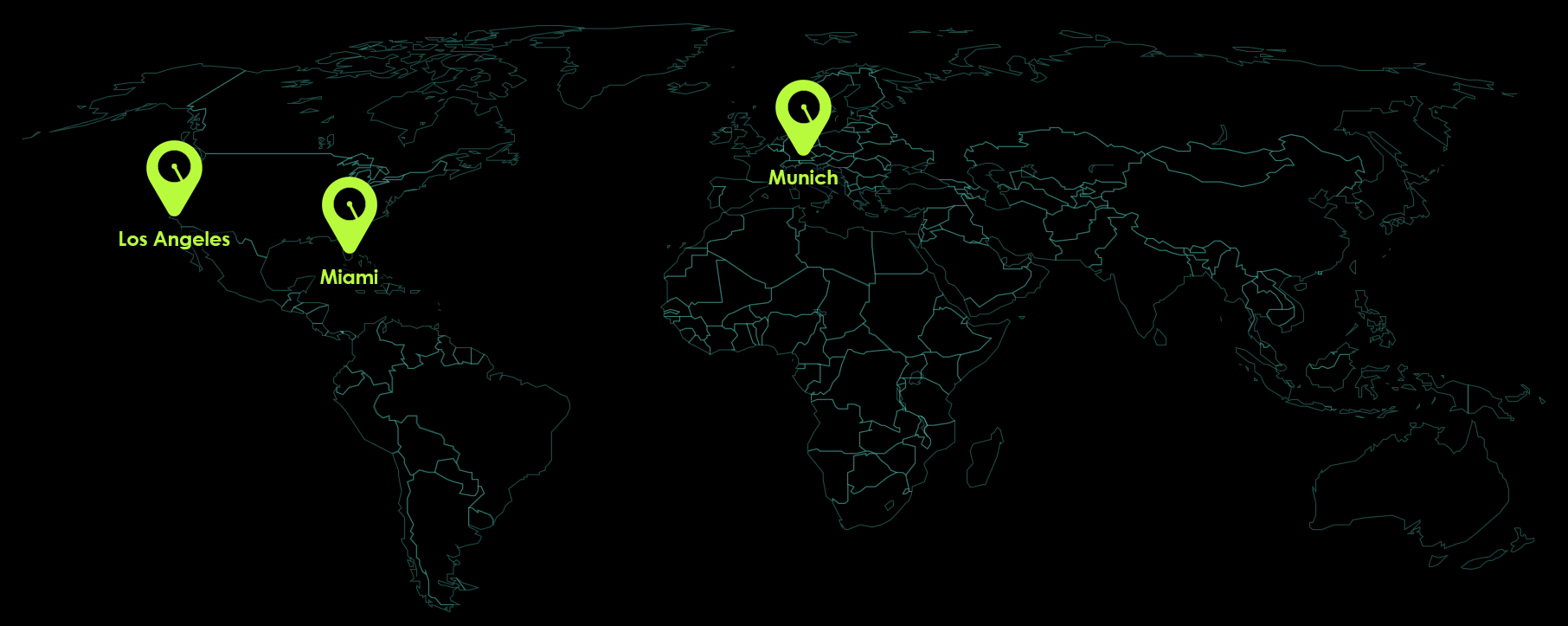

Why Radial?

These companies already rely on our expertise:

Frequently Asked Questions

What our customers say

Let’s Take the Next Step Together for Your Business Transition

A successful exit requires more than strong financials it demands foresight, structure, and the right advisory expertise. With our experience in corporate finance and a deep understanding of your company’s market positioning, we guide you from the initial analysis through to a successful closing. Let’s shape the path to a smooth transaction and unlock the value that truly reflects the strength of your business.