Why Transaction and Business Valuation Methods

A strong valuation model is more than a spreadsheet – it’s the foundation for confident decision-making. Our models create transparency, link cash flows, profitability, and equity value, and apply proven methods such as discounted cash flow and comparable company analysis. By combining data, structure, and logic, we deliver valuations that reflect real performance and provide confidence in pricing and negotiations.

Our Process and Timeline

The duration of each project depends on its individual scope and requirements and therefore cannot be generalized. The timeline below serves as an example to illustrate our approach and provide a better understanding of the typical phases. Your specific project schedule will be predefined together during the initial planning stage.

Every business valuation needs structure but not bureaucracy. Our process ensures every valuation model and used valuation method is implemented efficiently, turning complex cash flows into actionable insights. From the first idea to the final valuation, each step is transparent, traceable, and aligned with your strategic goals.

Turning Complexity into Clarity: Understanding Valuation

Valuations don’t have to be complicated. We help you determine value precisely and simplify your processes. Our models are built on transparent valuation methods and adapt to your specific business reality.

Whether you are preparing a deal, convincing investors, or evaluating internal projects our models deliver results that stand up to scrutiny. Transparent, reliable, and right to the point.

Turning Data into Tangible Valuations

A solid valuation doesn’t happen by chance it requires structure, logic, and the right tools to connect every element. Our approach ensures that you stay in full control at all times and quickly gain a well-founded valuation.

The result is a valuation model that goes beyond pure calculation it makes connections visible, enables faster decisions, and strengthens your position in negotiations.

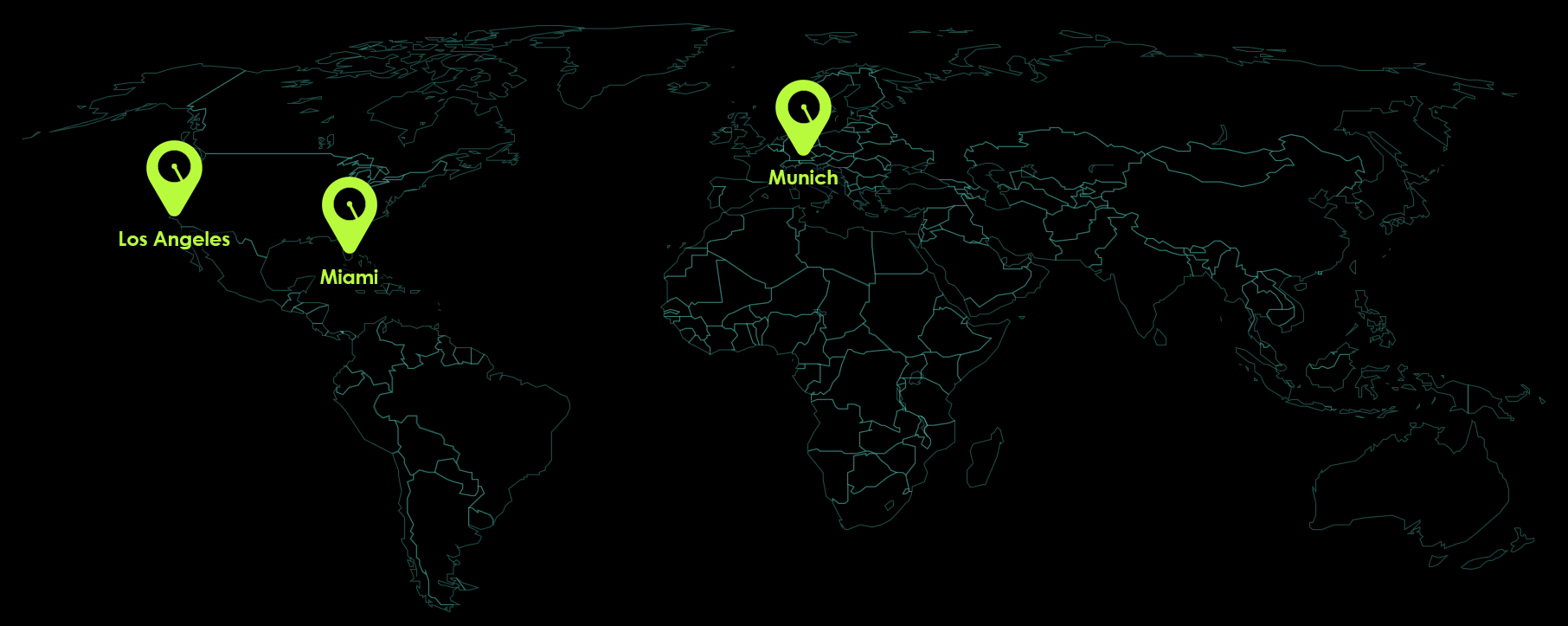

Why Radial?

These companies already rely on our expertise:

Frequently Asked Questions

What our customers say

Clarity Through a Strong Business Valuation Model

A robust valuation model provides direction from the first analysis to the final decision. Every assumption and valuation method is clearly defined, every calculation traceable, and the valuation outcomes give you confidence in pricing, risk, and strategy.

We help you develop a business valuation model that goes beyond simple numbers. It connects logic, data, and proven valuation techniques to deliver an accurate valuation. The result is a tool that supports you through deals, negotiations, and long-term decisions turning valuation into a driver of clarity and measurable business value.