Transactions

Structured deals, clear insights, faster closings

We create transparency around the numbers that truly matter delivering insights that drive confident decisions.

With focused diligence, clear reporting, and SPA-ready outputs, you ensure faster, smoother, and value-driven deal closings.

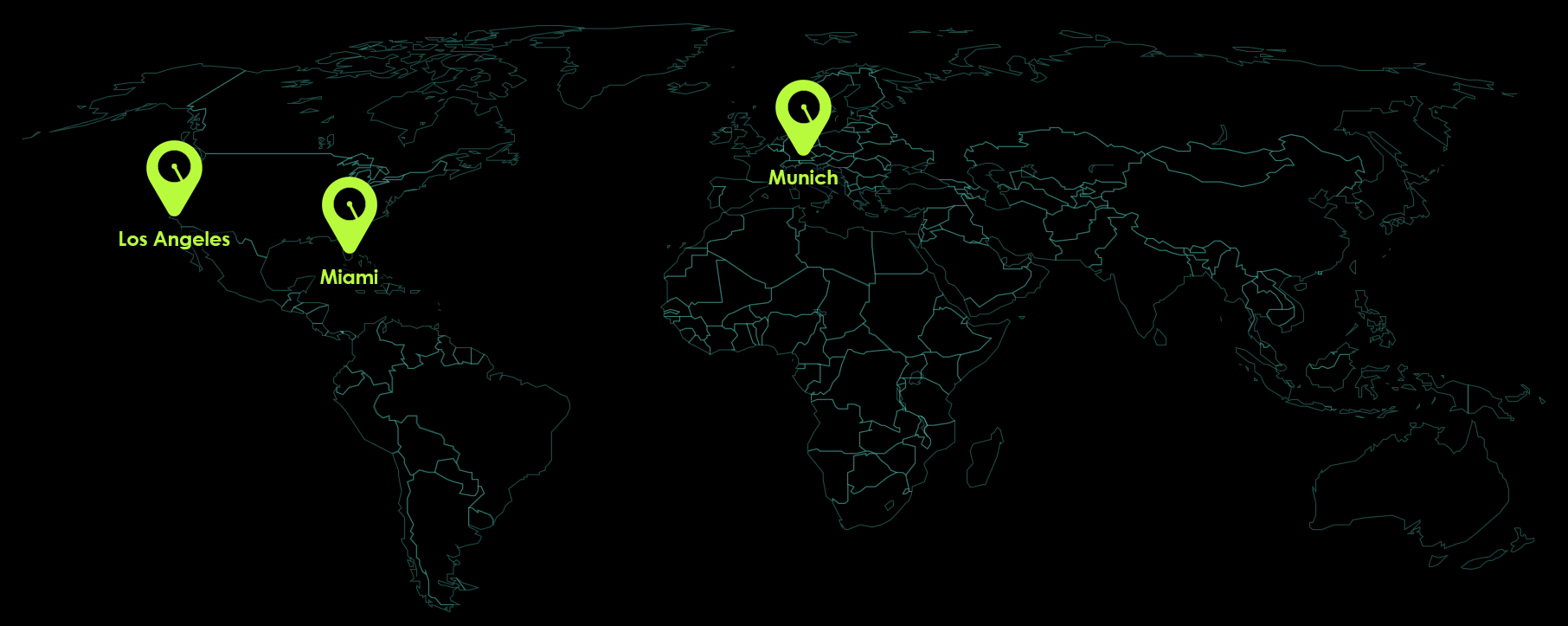

Radial Consulting known from:

Our Products

Deal support that surfaces what changes price, terms, and timing. We deliver focused diligence, net debt and working capital definitions, and SPA ready outputs that reduce risk and accelerate closing. Day 1 reporting and onboarding to turn thesis into action.

Tombstones

Here is a list of a few transaction advisory projects we successfully worked on over the past: