Why a Professional Business Valuation Matters

A sound business valuation provides the foundation for strategic decisions whether for a merger, acquisition, succession or financing. It reveals what a business is worth today and how its future earnings and cash flows may evolve.

By combining modern valuation methods with financial logic and operational insight, we make the company’s value transparent, consistent, and easy to understand.

Process and Timeline for a Business Valuation

The duration of each project depends on its individual scope and requirements and therefore cannot be generalized. The timeline below serves as an example to illustrate our approach and provide a better understanding of the typical phases. Your specific project schedule will be predefined together during the initial planning stage.

Valuing a company follows a clear, transparent process from data collection to the final valuation report. Our approach ensures that all relevant factors affecting the value of the business are considered, and that every result is traceable, verifiable, and aligned with accepted valuation standards.

What We Deliver for Valuation Approach

Radial develops tailored business valuation models that realistically reflect operational performance, market conditions, and future expectations. By combining proven methodologies with modern data analysis, we determine enterprise value in a transparent and comprehensible way.

Do You Know the True Value of Your Business?

A sound business valuation reveals the value of a company today and the potential within its future earnings and future cash flow. We help you value your business realistically and translate that business value into actionable insight.

Whether for a sale, succession, or growth initiative, we combine proven valuation methods with deep financial expertise making your numbers clear, consistent, and easy to understand.

Technology and Reporting for Transparent Business Valuations

A credible business valuation depends on structure, data quality, and transparency. With modern models and tools, Radial ensures that every valuation process is understandable, verifiable, and professionally documented, making the business’s value transparent for all stakeholders.

Our Technical and Methodological Foundations:

This combination of expertise, structure, and technology ensures that each business valuation is more than just a financial model it becomes a reliable tool for strategic decision-making.

Business Valuation Methods

Different ways to value are used to determine a company’s worth from various perspectives. Each method is based on its own financial logic and contributes to building a realistic and comprehensive view of enterprise value.

Income Approach

The income-based valuation method determines enterprise value based on the company’s expected future earnings, discounted to present value using a capitalization rate. This valuation approach is often used to reflect the time value of money and provides a forward-looking measure of business value.

It’s particularly suitable for businesses with predictable cash flows and strong financial performance.

Market Multiple Approach

Under the multiple method, company value is derived using a multiplier such as EBITDA or revenue. This approach compares similar companies within the same industry and provides a fast, market-oriented estimate of value.

Each of these business valuation methods has its strengths.

This approach is often used to use the market approach when establishing an estimate of value for public companies and private firms alike.

Asset-Based Approach

The asset-based approach (or asset-based valuation) calculates book value by adding up all business assets and subtracting liabilities. It reflects the value of its assets based on balance sheet data and helps determine liquidation value and net asset value for the subject company.

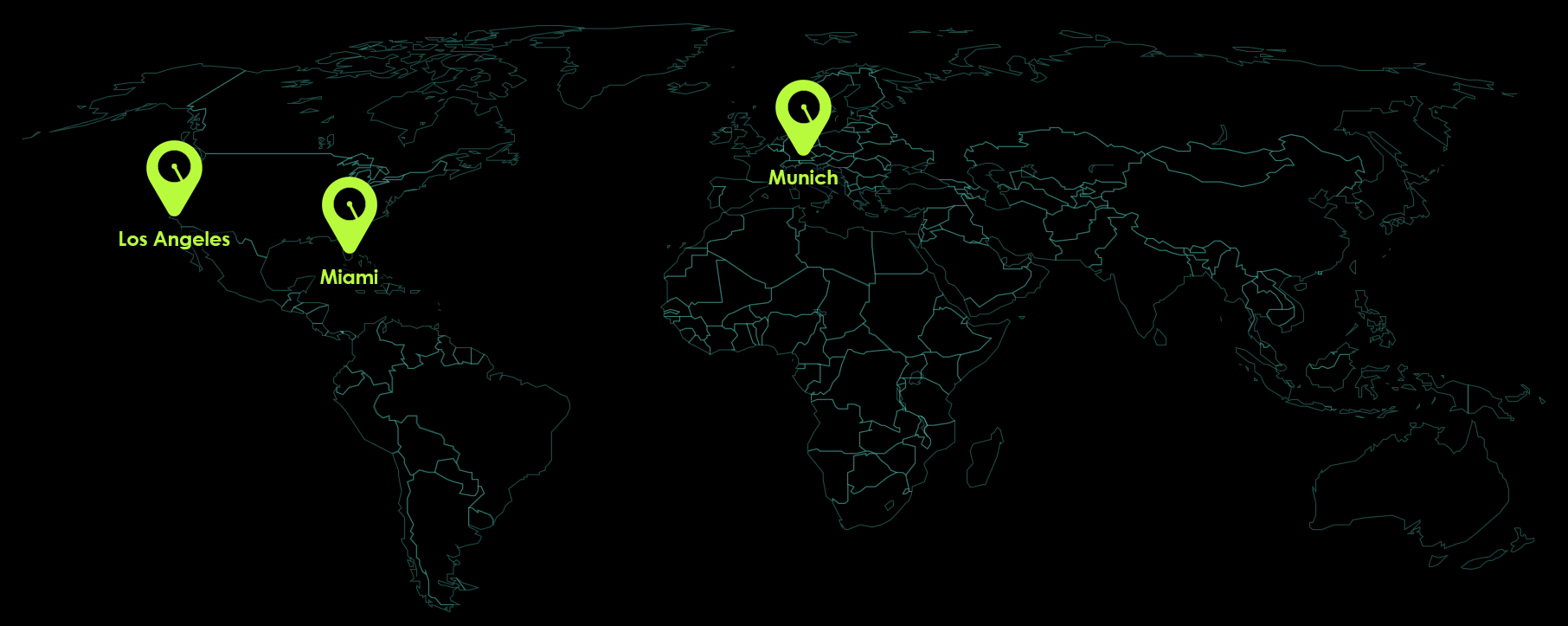

Why working with Radial takes you to the next level

These companies already rely on our expertise:

Frequently Asked Questions

What our customers say

Clarity on the True Value of Your Business

A professional business valuation is more than a calculation it’s the foundation for sound strategic decisions.

Whether you are planning a succession, sale, or growth initiative, we help you determine your company’s true enterprise value based on reliable methodologies and tailored assumptions.

With proven approaches such as the income approach, the discounted cash flow (DCF) method, and industry-specific multiples, we combine data, market insight, and financial expertise to provide a realistic and future-focused valuation.

If you want to understand what your business is worth today and going forward we stand by your side as a reliable partner.

Contact us to bring clarity, transparency, and confidence to your numbers.