Why Working Capital Optimization Matters

A targeted approach to working capital optimization improves liquidity, reduces tied-up capital, and strengthens financial flexibility. With effective working capital management, companies unlock potential across accounts payable, accounts receivable, and inventory management, driving a healthier cash flow and stronger balance performance.

Our Process for Working Capital Optimization

Each project’s duration depends on its scope and requirements, so timelines are defined individually during the initial planning phase. A successful working capital optimization begins with clear analysis and follows a structured process that turns insights into measurable improvements, ensuring liquidity gains become visible in the short term.

Ways to improve working capital efficiently

If too much capital is tied up or processes aren’t running efficiently, it’s time to review your net working capital. A targeted approach to optimizing your working capital releases liquidity, enhances cash flow, and builds flexibility into your financial structure.

Together, we identify options to increase efficiency, streamline payment cycles, and ensure future cash stability. Our approach helps you optimize every aspect of your working capital improving both operational performance and long-term cash positions.

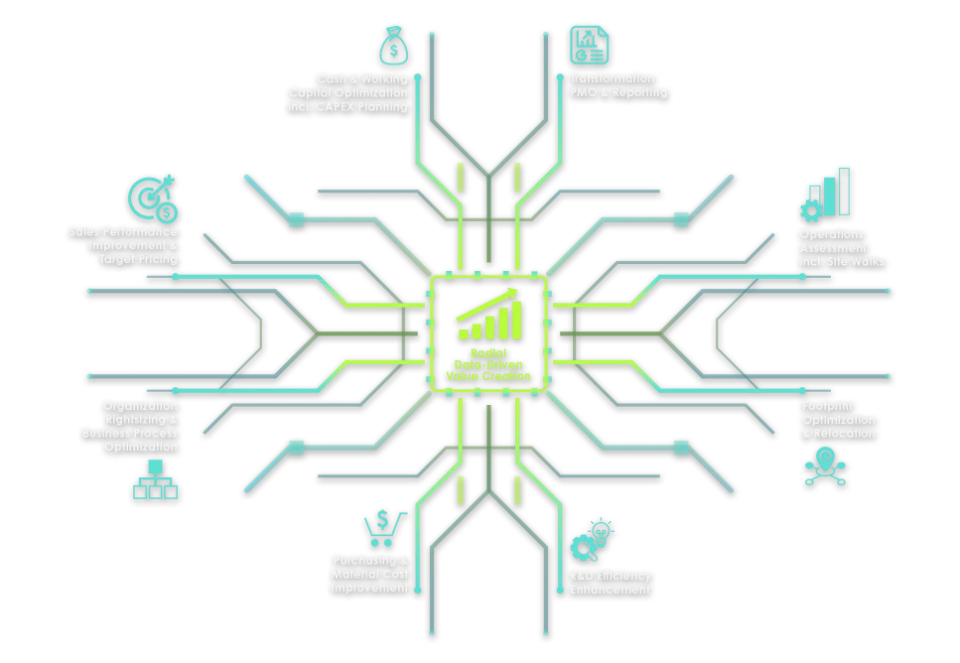

Digital Tools to improve working capital management

Modern working capital management depends on transparency, automation, and real-time data. By leveraging cutting-edge technology, Radial connects systems, processes, and metrics into a single source of truth turning data and analytics into actionable insights for better business decisions and liquidity.

Our Technical Implementation Includes:

This creates a system that goes beyond numbers improving operational control and treating liquidity as a strategic resource.

Key Measures to optimize working capital

Working capital optimization focuses on three core areas that together strengthen a company’s liquidity and operational effectiveness in a lasting way.

Improve Receivables Management

Optimize Inventory Management

Structure Payables Management

Why Radial?

These companies already rely on our expertise:

Frequently Asked Questions

What our customers say

Stability Starts with Efficient Capital & Cash Flow

Successfully optimizing your working capital creates room for growth and builds a foundation for long-term resilience. When processes, cash flows, and resources align, true efficiency emerges visible in daily operations and tangible in liquidity.

Reduce capital tie-up, secure planning flexibility, and achieve lasting improvement in liquidity. We help you build a system that doesn’t just manage value – it moves it.