Why Cost and Margin Improvement Matters

A focused margin improvement program strengthens both short-term results and long-term business profitability. By balancing cost reduction with smart pricing strategy, companies can increase profitability while stabilizing their financial foundation.

Organizations that refine their cost structure and strengthen their gross profit margin quickly uncover hidden potential in how they price, produce, and deliver their product or service. A structured approach reduces wasted effort, improves financial clarity, and helps the business focus on the initiatives that create the most value.

When teams understand key margin drivers, align responsibilities, and act strategically, they improve your profit margin and create a more profitable business turning financial clarity into sustainable performance and a higher margin competitive advantage.

Our Process to improve your Pricing Strategy & Profitability

The duration of each project depends on its individual scope and requirements and therefore cannot be generalized. The timeline below serves as an example to illustrate our approach and provide a better understanding of the typical phases. Your specific project schedule will be predefined together during the initial planning stage.

Every optimization begins with clarity: clarity about numbers, drivers, and potential. Our structured approach helps you identify areas for improvement, strengthen your margin, and achieve meaningful financial progress within weeks.

Ways to Improve that Pay Off Quickly

Improving your margin and strengthening your company’s profit is never theoretical – it translates directly into measurable results. By analyzing your financials, refining costing, and focusing on actions that increase profitability, you unlock practical steps that improve your profit margin and reinforce long-term stability.

Through smarter pricing strategy, efficient processes, and a clear view of your cost drivers, your organization achieves meaningful cost savings, healthier gross margin, and improved cash flow all supporting long-term value creation and a stronger EBITDA outlook.

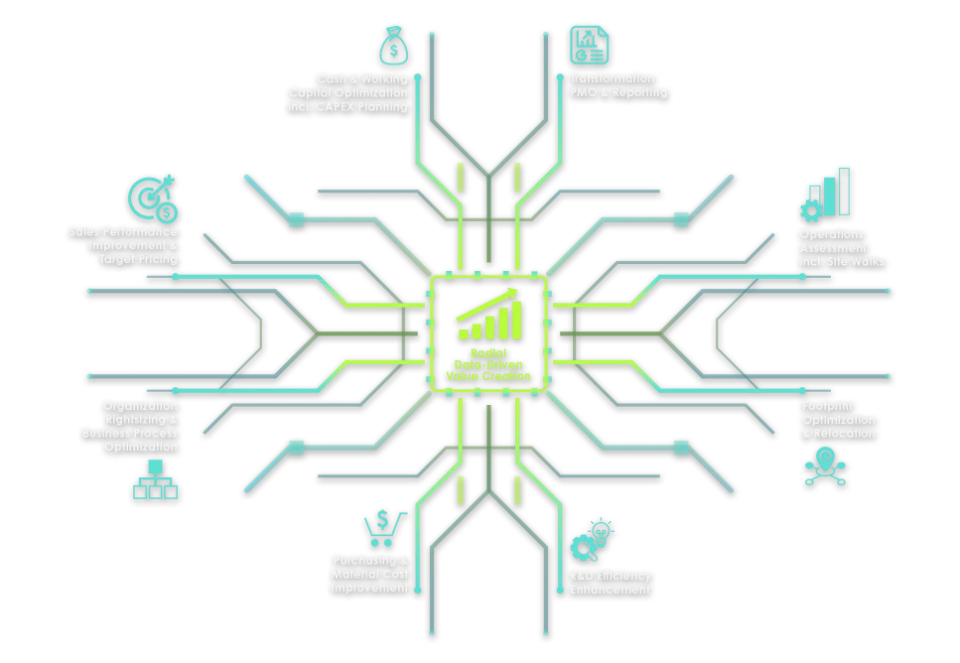

Technology That Improves your Profit Margin and Cost Reduction

Our tools and dashboards provide full transparency on margin performance, financial trends, and the initiatives that deliver the strongest impact. They show how pricing, costing, and process changes influence your company’s gross profit margin in real time.

By combining seamless data integration with intuitive visual reporting, you maintain a clear view of results, trends, and opportunities – anytime, anywhere.

Cost and Margins in Practice

Strong margin performance is one of the clearest indicators of financial health and long-term stability. It shows how effectively a company turns revenue into company’s gross profit, independent of financing or accounting effects.

How cost and margin insights are used:

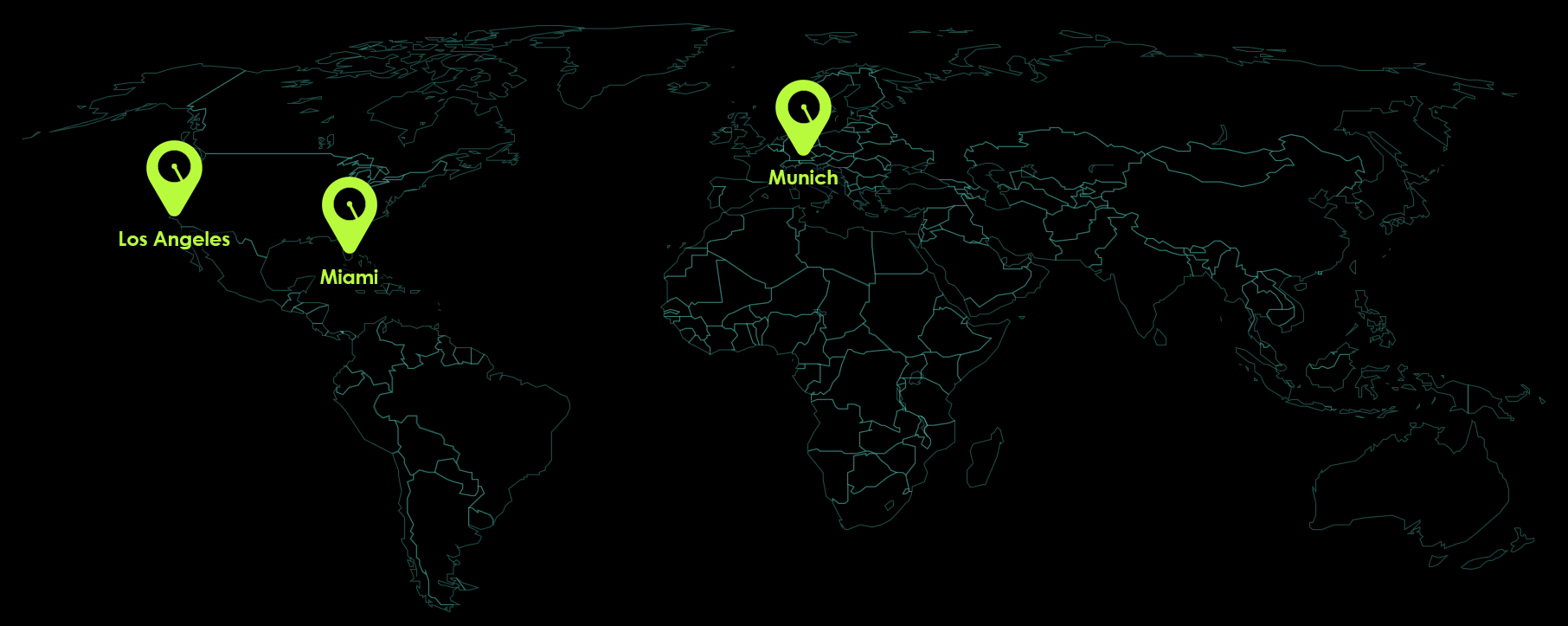

Why Radial?

These companies already rely on our expertise:

Frequently Asked Questions

What our customers say

Operational Efficiency to Improve Profitability

A strong margin is never a coincidence it results from clarity, structure, and consistent execution. By turning data into actionable insights, you can refine processes, improve costing, and build healthier gross margin and long-term company’s profitability.

Whether in sales, production, or financial control, we help you understand the performance metrics that matter most and embed them sustainably into your daily operations. With Radial, you gain the strategies to increase your margins, strengthen your cost structure, and support long-term financial resilience.