Why implement an ESG strategy is Critical for Companies

A structured implementation of ESG strengthens your company’s long-term resilience. It makes sustainability, social responsibility, and good ESG measurable creating transparency for stakeholders and improving access to capital over time. By strategically implementing an effective ESG strategy into core business practices, companies enhance competitiveness, build trust, and secure sustainable success.

ESG Implementation Process

Each ESG project is defined individually based on its scope and requirements. A successful implementation starts with clear analysis and leads to the structured execution of your ESG strategy. Our approach provides clarity, direction, and a solid foundation for sustainability, governance, and effective ESG reporting that drives long-term value.

Implement ESG Successfully and Make It Visible

A structured ESG implementation creates clarity, builds trust, and makes sustainability measurable. Greater transparency strengthens both internal alignment and external credibility, ensuring long-term impact.

Together, we translate your ESG goals into actionable metrics and results. This turns ESG reporting into a strategic management tool that drives progress, strengthens confidence, and ensures compliance with ESG standards.

Technology as the Foundation of an ESG Strategy in a company

Effective ESG implementation depends on having the right digital systems and tools in place to collect, evaluate, and visualize ESG data securely. Through clear structures and technology-driven processes, we help implement an ESG strategy that builds a measurable ESG framework for sustainability and corporate governance.

Our Technical Implementation Includes:

ESG Criteria Across Core Areas of Action

Our approach covers environmental, social, and governance dimensions embedding sustainability, governance, and social responsibility deeply into your organization and existing business processes.

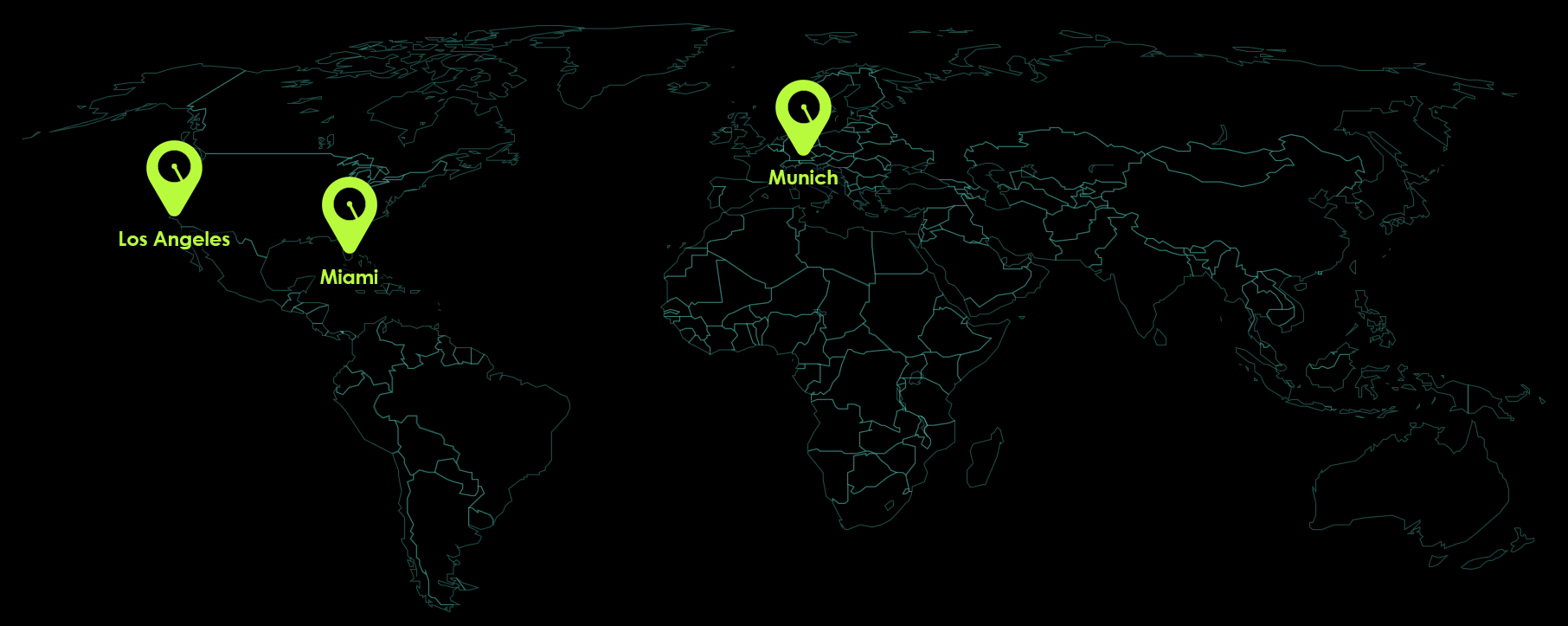

Why Radial?

These companies already rely on our expertise:

Frequently Asked Questions

What our customers say

Sustainability as a Measure of Progress

For small and mid-sized companies, sustainability has become a critical success factor in today’s business environment. A clear assessment of ESG performance helps identify opportunities and make responsibility visible.With well-defined ESG KPIs and selected reporting standards, organizations can evaluate ESG factors and track progress in your ESG journey transparently across both internal and external dimensions. This turns sustainability into an ongoing process that creates impact and builds trust within the organization and among stakeholders alike.