Why Cash Flow Forecast & Liquidity Planning Matters

We design tailored liquidity planning frameworks built around your business model giving you daily visibility, weekly control, and long-term planning certainty while clarifying how changing cash inflows and outflows affect solvency. A strong liquidity plan strengthens risk management, prevents negative cash situations early, and helps you assess upcoming needs, protect your financial health, and make confident decision-making possible for future growth.

Process and Project Structure

Project duration depends on scope and requirements; the example below illustrates a typical Liquidity Planning implementation. Your individual project timeline will be defined during the initial planning phase. Our liquidity planning process delivers precise forecasts and automated dashboards seamlessly integrated with your financial data. You gain real-time visibility into liquidity, empowering confident and strategic decision-making.

Ready to Strengthen Your Cash Flow Forecasting and Liquidity Planning?

Whether you are building your liquidity plan from scratch or optimizing an existing structure, now is the right moment to professionalize your cash and liquidity management. Together, we design a planning model tailored to your business giving you full transparency and the insights to act decisively.

Tech-Enabled Implementation of Liquidity Planning Models

Our liquidity planning models are built on proven technologies and fully automated. They connect data sources in real time, support precise analysis, and create full transparency over your financial position.

This creates a reliable, scalable planning solution that supports predicting future requirements, strengthens stability, and enables confident decisions across your organization.

The Benefits of Liquidity Management Planning

Effective liquidity planning gives your business real-time transparency, strengthens financial health, and protects against negative cash situations. With accurate cash flow insights and automated forecast logic, you can ensure stability, optimize capital, and support sustainable long-term planning.

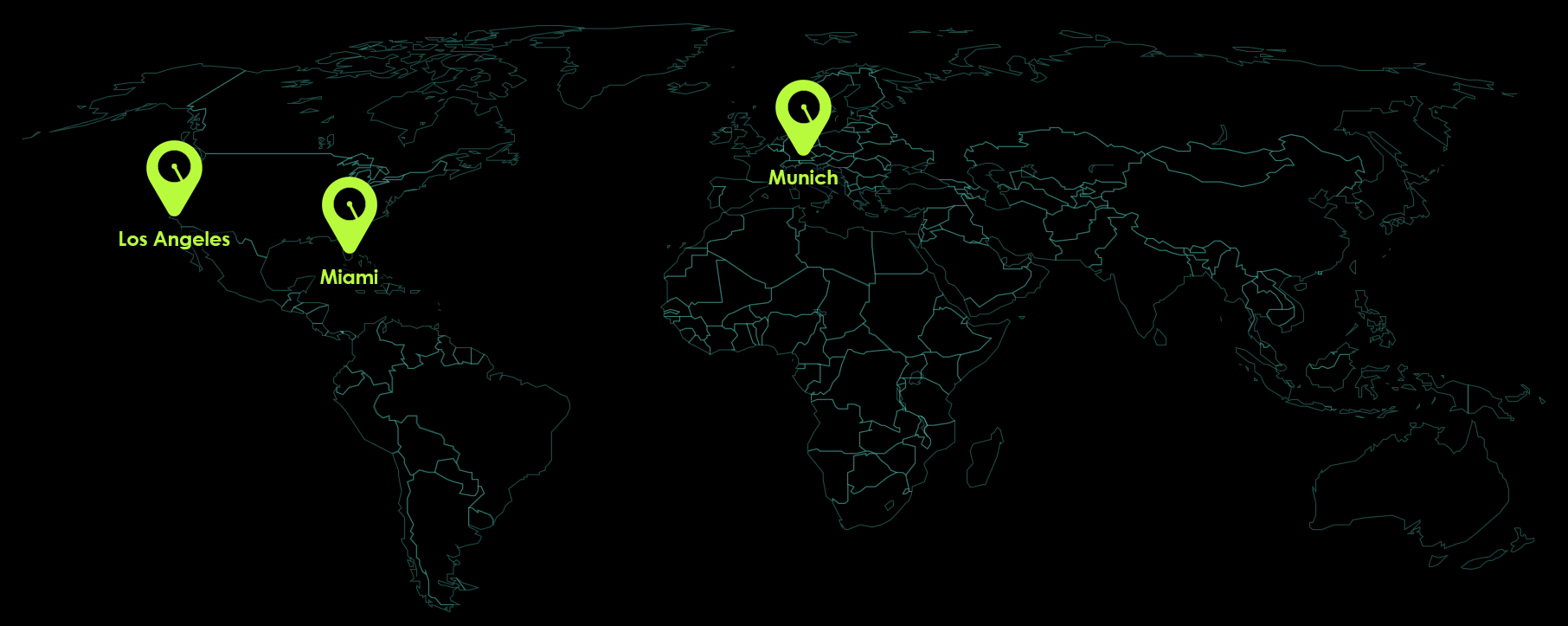

Why Radial?

These companies already rely on our expertise:

Frequently Asked Questions

What our customers say

From Liquidity Planning to Proactive Cash Flow Management

If you want to move beyond static numbers and achieve real control, we’re your optimal partner. Our liquidity planning and cash flow management tools use automated data collection and scenario logic to simulate future developments and highlight risks early.

With Radial, you can identify liquidity shortages before they occur, strengthen cash planning, and turn your financial management into an actionable, reliable system. We help you select the right planning approach from short-term liquidity planning to long-term forecasts ensuring stability and strategic clarity across every scenario.