Why Financial Onboarding Process Matters

Financial onboarding lays the foundation for a successful M&A transaction because strategic decisions, due-diligence insights, and operational workflows must be quickly translated into clear structures, KPIs, and responsibilities. A well-prepared onboarding process ensures that acquiring and acquired companies can work effectively together within the first 100 days, minimizing risks and realizing synergies early. After the due-diligence phase, the process begins: the quality of the start determines whether a merger or acquisition proceeds smoothly or whether disruption, financial losses, and reduced synergy realization may threaten long-term success.

A Clear Structure for a Smooth Financial Onboarding

A successful financial onboarding after a transaction doesn’t happen by chance. It requires an organized process built on strategy and data. Our approach connects due-diligence insights with clear responsibilities, defined synergies, and a structured roadmap for the first 100 days. The actual duration always depends on the scope of the transaction, the new organizational setup, and the expectations of both companies.

Choose an Onboarding Approach That Actually Works

A lack of structure after closing can cause disruption, slow integration, and limit synergy realization. We make sure your financial processes work from day one and support a smooth transition during the early onboarding and integration process. If you want an onboarding process that is well-executed and aligned with your goals after a merger or acquisition, get in touch with us.

Technology and Tools for Unified Financial Structures

Effective onboarding depends on the right systems. We ensure reporting and operational steering work from day one, supporting a seamless integration and reducing early disruption. Our technology connects due-diligence findings, closing requirements, and new operational workflows into a unified structure that accelerates synergy realization across the newly combined organization.

Key Success Factors in Financial Onboarding

Why Radial?

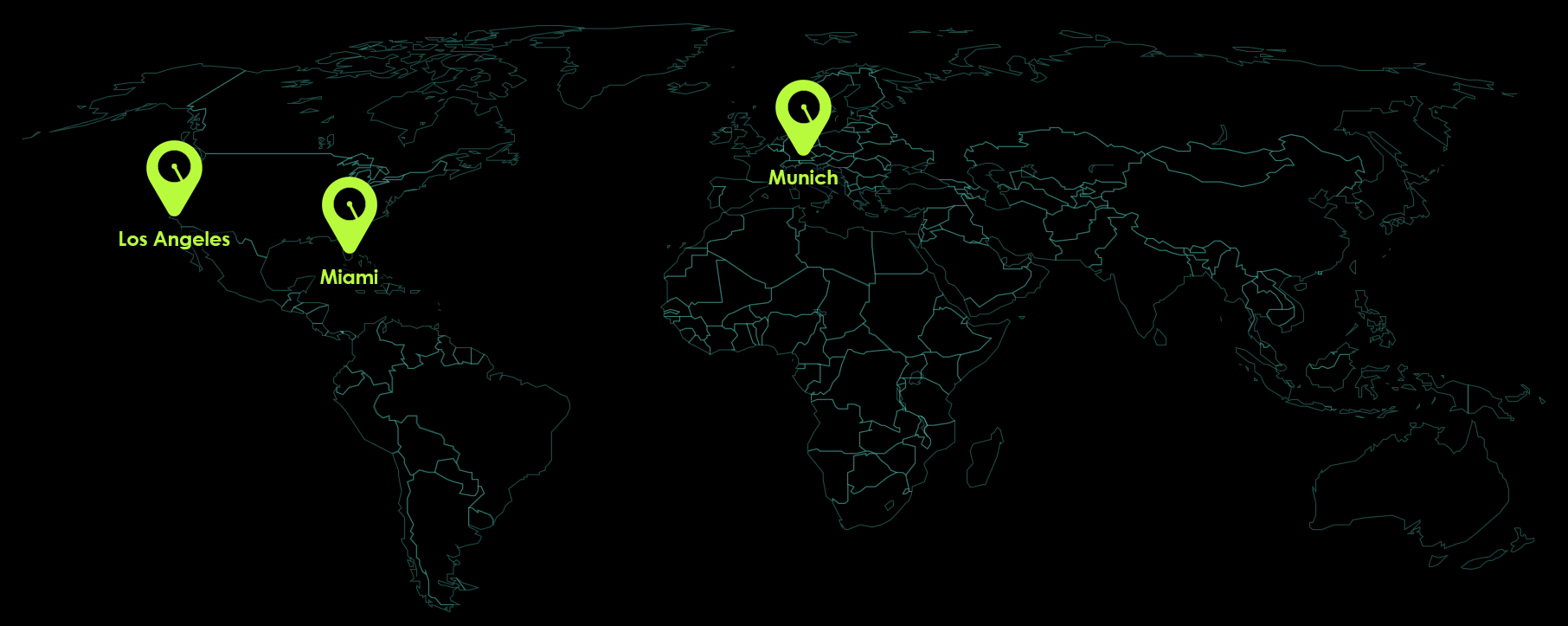

These companies already rely on our expertise:

Frequently Asked Questions

What our customers say

The Critical Transition Begins After Due Diligence

If you want to ensure that your financial onboarding truly works after an M&A integration, you need clear structures, consistent data, and an execution approach that supports both strategic and operational goals. We help you minimize risks, realize synergies early, and successfully navigate.