Why Financial Due Diligence is critical for sellers

n a company sale, the objective is not to reassess your business internally, but to present it from a buyer’s perspective in a structured, consistent and convincing manner. A sell-side Financial Due Diligence creates transparency, trust and comparability. It clearly demonstrates the financial stability of the business, the sustainability of earnings and the value drivers underlying the purchase price. This preparation supports an efficient sale process, reduces follow-up questions and provides a solid basis for purchase price discussions.

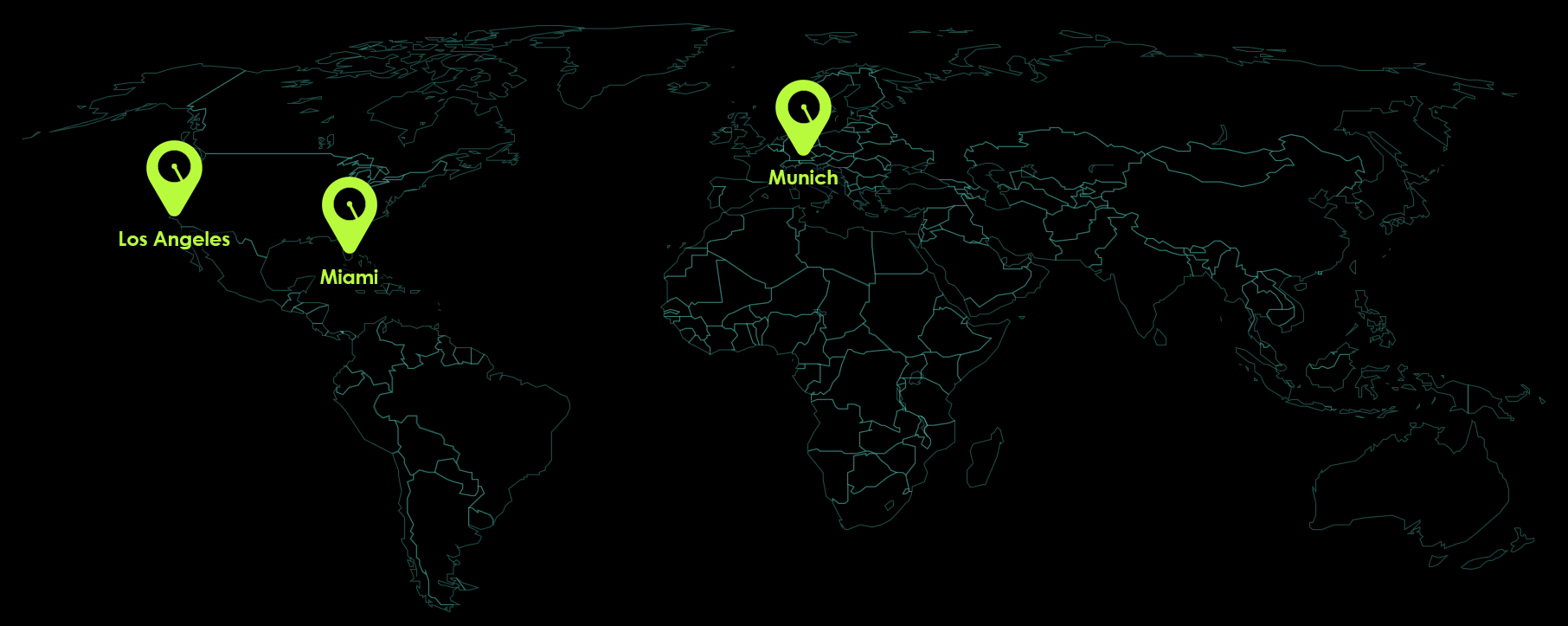

Tombstones

Here is a list of a few Sell-Side Financial Due Diligence projects we successfully worked on over the past:

Modern Tools for Transparent and Robust FDD

A sell-side FDD requires reliable systems, structured data management and traceable reporting. We use modern technologies to ensure all figures are consistent, audit-ready and fully transparent for buyers and advisers.

Key Elements of Sell-Side Financial Due Diligence

Why working with Radial takes you to the next level

Frequently Asked Questions

What our customers say

Prepare your exit strategically and with confidence

A sell-side Financial Due Diligence shapes how clearly value is articulated and how effectively pricing discussions are anchored in facts. By establishing a clean earnings baseline, applying disciplined normalisations and clearly evidencing value drivers, valuation outcomes can often be meaningfully improved – frequently by an amount that exceeds the cost of the due diligence by a wide margin.

If your objective is to reduce execution risk, create transparency and present enterprise value in a structured and defensible manner, we support you with experience, rigour and a transaction-ready approach. Get in touch to lay the groundwork for a successful company sale.